Consumer Insights

Uncover trends and behaviors shaping consumer choices today

Procurement Insights

Optimize your sourcing strategy with key market data

Industry Stats

Stay ahead with the latest trends and market analysis.

Trending Now

Base Year

Historical Period

Forecast Period

The Expert Market Research pricing report on n-Hexane provides insights into the top 10 leading trading countries and regions.

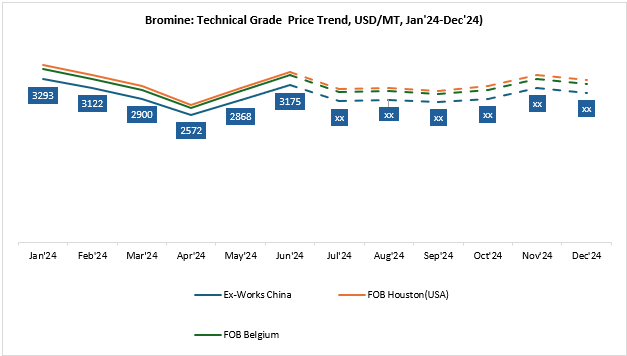

Bromine price trends experienced fluctuations throughout 2024, driven by changes in demand, supply constraints, and geopolitical tensions in major producing regions. Regional price trends varied across North America, Asia-Pacific, the Middle East, and Europe, reflecting local supply-demand dynamics, production capacities, and logistical challenges. The price outlook for Bromine in 2025 is expected to be mixed, with some regions seeing stable prices due to ongoing industrial demand, while others may face continued price pressure owing to supply chain disruptions, geopolitical policies, and fluctuating freight costs.

| Bromine: Technical Grade Price (USD/MT) YoY Change, Ex-works China | ||||

| Month | 2023 Price | 2024 Price | YoY Change | Expert Market Research Price Prediction for 2025 |

| October | 3315 USD/MT | 2900 USD/MT | - 13% | Prices are expected to remain moderately stable in H2 2025 due to the availability of inventories and procurement from the flame retardant and chemical sectors |

| November | 3460 USD/MT | 3115 USD/MT | - 10% | |

| December | 3525 USD/MT | 3015 USD/MT | - 14% | |

In China, bromine prices witnessed a decline in the last quarter of 2024 compared to the same period in 2023. This price drop was primarily driven by weakened demand from key downstream sectors such as flame retardants and drilling fluids, along with increased inventory levels in the region. Broader macroeconomic factors affecting bromine price forecast suggests that increasing pressure from competitive landscape and reduced export activity contributed to the decline. The global economic slowdown, particularly in manufacturing and construction sectors, along with cutdown of seasonal production costs and increasing adoption toward alternative, non-halogenated chemicals, further exerted downward pressure on price.

In 2024, Bromine prices fluctuated across regions with factors such as shifting demand, supply chain disruptions, and geopolitical tensions contributing to these variations. In Asia-Pacific, Bromine prices rose in the first half of 2024, initially affected by factors such as ample supply and weak demand, especially in China. Prices began rebounding in April due to lower inventories and pre-holiday restocking, with upward price movements observed in May amid limited imports. Mid-year saw stable pricing as supply and demand were balanced. Another price rise occurred in October, driven by low stock and stronger buying sentiment, with prices stabilizing again towards the end of the year owing to reduced production and subdued demand from key downstream sectors. In North America, prices rose in the first half of 2024 due to strong demand from flame retardant industries and supply constraints, before declining mid-year. In late 2024, a mixed price trajectory, influenced by reduced demand and geopolitical tensions, was observed. In MEA, the trend remained negative after the first half in with prices declining by the end of the year due to reduced demand from Asia and geopolitical challenges. In 2024, bromine prices in Europe fluctuated, with prices rising in October amid concerns over Middle East disruptions.

The global bromine market outlook in 2025 is projected to experience moderate price fluctuations, shaped by regional production and consumption dynamics, economy-wide growth and inflation pressures, and worldwide trade dynamics. In China, one of the largest producers of bromine, prices are expected to fluctuate within a limited range in early 2025, shaped by a demand recovery in key end-use industries, a balanced increase in supply, and large-scale economic stabilization. While the European market might witness stable to slightly rigid pricing, depending on energy costs, sustainability, and environment compliance regulations, and imports from major producing countries such as China and Israel. Geopolitical conflicts in the Middle East might impact the volume of bromine exports in regions such as Israel and Jordan, which may lead to price volatility. Overall, the price trends of Bromine in 2025 are expected to be stable to slightly bullish, especially in the second half of the year, assuming industrial activity recovers and global logistics remain tight.

| Leading Exporting Countries | Leading Importing Countries | Major Suppliers |

| Jordan | China | Albemarle Corporation (USA) |

| Belgium | United Kingdom | Chemada Industries Ltd. (Israel) |

| Lao People's Democratic Republic | Singapore | Gulf Resources, Inc. (China) |

| Japan | Netherlands | Hindustan Salts Ltd. (India) |

| India | Saudi Arabia | Honeywell International Inc. (USA) |

| United States of America | Canada | Israel Chemicals Ltd. (Israel) |

| Hungary | France | Jordan Bromine Company (Jordan) |

| Thailand | South Korea | Lanxess AG (Germany) |

The bromine market is currently facing significant challenges and opportunities impacted by cross-border tensions, economic dynamics, and environmental regulations. The ongoing Israel-Hamas conflict has disrupted the global bromine supply chain, affected Israeli producers, and prompted a reliance on alternative sources like Jordan. This geopolitical instability has also led to rerouted shipping operations around the Cape of Good Hope, adding time and costs to deliveries.

However, in the U.S., the bromine market was stable despite these external forces in play, with prices remaining steady throughout January 2024. However, the conflict’s impact on Israeli production, in 2024, coupled with the need to rely on alternative sources like Jordan, has contributed to a gradual decrease in bromine prices due to increased product availability at lower rates. Therefore, the bromine price trend is shaped by a combination of factors such as the state of the international political landscape, regulatory pressures, and market shifts towards sustainability.

In 2024, bromine production costs were slightly influenced by fluctuations in brine availability and energy inputs, especially in China and Israel, the key producers. During the first half of 2024, constrained brine extraction in China's Shandong province due to environmental controls and water management policies tightened supply, elevating bromine production costs. Meanwhile, stable brine extraction in Israel kept production steady, although energy price fluctuations along with political instability still imposed marginal cost pressures. Overall, feedstock-related fluctuations did not significantly impact bromine pricing analysis, as downstream demand and supply dynamics played a more dominant role.

The outlook for bromine in 2025 is expected to be moderately optimistic, with steady growth in demand driven by key applications in flame retardants, oil and gas drilling fluids, water treatment, and emerging sectors like energy storage. Econometric market analysis also suggests that the flame-retardant segment, with a focus on construction and electronics, is expected to remain a major demand driver due to stringent fire safety regulations, especially in Asia and North America. The use of bromine in clear brine fluids for oil field operations is also projected to rise in line with increased global drilling activity. In addition, bromine's role in energy storage technologies, such as zinc-bromine flow batteries, is gaining traction along with the global transition to renewable energy, adding a potential new stream of demand.

On the supply side, production is expected to remain stable, from major producers in the USA, Jordan, and growing capacities in China and India. However, environmental regulations in Europe and increasing focus on sustainable chemicals may constrain certain brominated product lines. Moreover, logistical disruptions and international policy developments could influence bromine delivery, particularly for suppliers using maritime transport as transit. Overall, the market is likely to remain balanced, with producers cautiously optimistic about meeting rising global demand.

Gain a competitive edge with Expert Market Research's comprehensive price forecasting reports. Dive deep into the latest market dynamics and price outlook for your specific materials, ensuring you stay ahead of the curve with actionable insights and strategic foresight.

Our market research reports cover a wide range of commodities, including chemicals (including speciality chemicals), metals, agricultural ingredients, and energy. Each report focuses on a specific commodity to provide detailed insights.

Our reports are updated monthly to provide the most current data and insights. Users can also subscribe to quarterly or semi-annual updates based on their needs.

We source our data through primary interviews with our supplier and trader network, government websites, industry bodies, and world trade data, ensuring accuracy and reliability.

Yes, we offer custom reports tailored to your specific needs. Please contact our support team for more information.

Our reports provide critical insights that help you anticipate market trends, optimize procurement strategies, and make informed investment decisions. This leads to better negotiation and timing in purchases, thereby reducing the impact of price volatility.

Clients can receive analyst support to answer specific questions related to the reports. Additionally, we offer services like risk management, category intelligence, should-cost models, and trade data analytics as part of our extended suite of offerings.

Basic Report -

One Time

Basic Report -

Annual Subscription

Detailed Report -

One Time

Detailed Report -

Annual Subscription

Basic Report -

One Time

USD 799

tax inclusive*

Basic Report -

Annual Subscription

USD 3,499

tax inclusive*

Detailed Report -

One Time

USD 4,299

tax inclusive*

Detailed Report -

Annual Subscription

USD 7,999

tax inclusive*

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Small Business Bundle

Growth Bundle

Enterprise Bundle

*Please note that the prices mentioned below are starting prices for each bundle type. Kindly contact our team for further details.*

Flash Bundle

Number of Reports: 3

20%

tax inclusive*

Small Business Bundle

Number of Reports: 5

25%

tax inclusive*

Growth Bundle

Number of Reports: 8

30%

tax inclusive*

Enterprise Bundle

Number of Reports: 10

35%

tax inclusive*

How To Order

Our step-by-step guide will help you select, purchase, and access your reports swiftly, ensuring you get the information that drives your decisions, right when you need it.

Select License Type

Choose the right license for your needs and access rights.

Click on ‘Buy Now’

Add the report to your cart with one click and proceed to register.

Select Mode of Payment

Choose a payment option for a secure checkout. You will be redirected accordingly.

Gain insights to stay ahead and seize opportunities.

Get insights & trends for a competitive edge.

Track prices with detailed trend reports.

Analyse trade data for supply chain insights.

Leverage cost reports for smart savings

Enhance supply chain with partnerships.

Connect For More Information

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

Our expert team of analysts will offer full support and resolve any queries regarding the report, before and after the purchase.

We employ meticulous research methods, blending advanced analytics and expert insights to deliver accurate, actionable industry intelligence, staying ahead of competitors.

Our skilled analysts offer unparalleled competitive advantage with detailed insights on current and emerging markets, ensuring your strategic edge.

We offer an in-depth yet simplified presentation of industry insights and analysis to meet your specific requirements effectively.

Australia

63 Fiona Drive, Tamworth, NSW

+61-448-061-727

India

C130 Sector 2 Noida, Uttar Pradesh 201301

+91-723-689-1189

Philippines

40th Floor, PBCom Tower, 6795 Ayala Avenue Cor V.A Rufino St. Makati City,1226.

+63-287-899-028, +63-967-048-3306

United Kingdom

6 Gardner Place, Becketts Close, Feltham TW14 0BX, Greater London

+44-753-713-2163

United States

30 North Gould Street, Sheridan, WY 82801

+1-415-325-5166

Vietnam

193/26/4 St.no.6, Ward Binh Hung Hoa, Binh Tan District, Ho Chi Minh City

+84-865-399-124

United States (Head Office)

30 North Gould Street, Sheridan, WY 82801

+1-415-325-5166

Australia

63 Fiona Drive, Tamworth, NSW

+61-448-061-727

India

C130 Sector 2 Noida, Uttar Pradesh 201301

+91-723-689-1189

Philippines

40th Floor, PBCom Tower, 6795 Ayala Avenue Cor V.A Rufino St. Makati City, 1226.

+63-287-899-028, +63-967-048-3306

United Kingdom

6 Gardner Place, Becketts Close, Feltham TW14 0BX, Greater London

+44-753-713-2163

Vietnam

193/26/4 St.no.6, Ward Binh Hung Hoa, Binh Tan District, Ho Chi Minh City

+84-865-399-124

Share